Natural disasters and unexpected losses can strike at any time, leaving homeowners, renters, and business owners vulnerable to significant financial setbacks. One of the most effective ways to prepare for these unforeseen events is by creating a comprehensive home inventory—a detailed list of household and personal belongings, along with their approximate value.

As Jeanne Salvatore of the Insurance Information Institute emphasizes, the format of your home inventory is less important than simply having one. “Just going around your home with a pen and paper taking notes, or making a video with your smartphone of yourself walking through your home and describing the things around you, can make a world of difference when you need to make a claim,” she advises.

A home inventory is a practical tool for everyone—not just for the wealthy. In fact, individuals and families of modest means stand to benefit the most, as they rely on their insurance payouts to replace essential items. As Salvatore notes, “People always say they don’t have a lot of stuff. But if you add up the cost of your bed, mattress, bed frame, a few suits, electronics, small appliances, and maybe a bike or golf clubs, it easily adds up to thousands of dollars.” After a disaster, those funds can be critical for getting your life back on track.

Yet, despite the importance of a home inventory, less than 40 percent of households have compiled a detailed record of their belongings. This gap can lead to prolonged claim processing times and even jeopardize the ability to recover the full value of your loss.

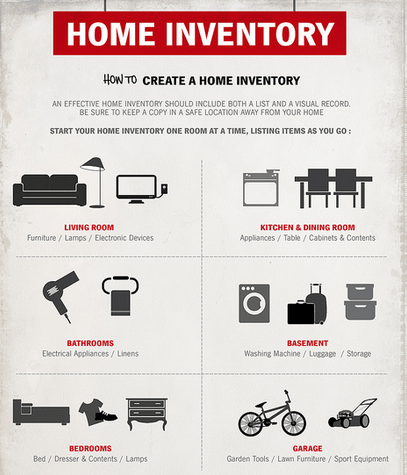

Creating a home inventory is simpler than many people think. Start by listing your belongings and estimating their value. Save receipts for high-value items, take photographs, and record serial numbers where possible. Even if you don’t have receipts, credit card statements, notes about where and when the item was purchased, or warranty information can support your claim.

For families, involving children in the process can be a valuable learning opportunity. Have them photograph their own rooms and personal items, such as electronics, gaming consoles, and sports equipment.

While DIY approaches are effective, some homeowners choose to hire professional home inventory companies for added accuracy and peace of mind. These services, typically costing between $500 and $800, can save homeowners thousands of dollars in the event of a loss. A third-party inventory adds credibility and can help eliminate disputes over the legitimacy of a claim, reducing the burden of proof on the homeowner.

Once your inventory is complete, consider sharing a copy with your insurance agent to ensure your coverage is adequate. Updating your home inventory annually is also a best practice—set a recurring date, such as the start of a new year or an anniversary, to keep your records current.

Remember to account for everything, from the contents of your garage—like tools, lawn equipment, and sporting gear—to wardrobes, furniture, appliances, and sentimental items like artwork or jewelry. Even if these items are irreplaceable, documenting their value can help ensure a fair payout under your policy.

Having a thorough and up-to-date home inventory can make a significant difference when filing an insurance claim. However, understanding what your policy covers and how to navigate the claims process can still be challenging. That’s where Mineo Salcedo Law Firm comes in.

Our team of experienced attorneys helps homeowners, renters, associations, and businesses protect their rights when dealing with insurance companies. We assist clients in interpreting complex policy language, pursuing denied or delayed claims, and ensuring they receive the compensation they deserve. If you’re facing an insurance dispute or simply want to ensure your interests are protected, contact Mineo Salcedo Law Firm today. Let us advocate for you—because your peace of mind and financial future deserve nothing less.